46+ where does mortgage interest go on tax return

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an. Web Where do I enter mortgage interest.

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Web You would use a formula to calculate your mortgage interest tax deduction.

. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. If they are incurred for the purpose of earning income by renting.

Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web Because a mortgage commits you to years of payments lenders want to make sure your loan is affordable to you both now and years down the road. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The IRS places several limits on the amount of interest that you can deduct each year. In this example you divide the loan limit 750000 by the balance of your mortgage.

Beginning in 2018 the. Homeowners who bought houses before. If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction.

Web Open your return. For tax years before 2018 the interest paid on up to 1 million of acquisition. Web TurboTax Canada.

Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the. Over 90 million taxes filed with TaxAct. TurboTax Makes Filing Tax Returns Easy With Simple Step-By-Step Instructions.

Web Contact your lender if you think that your 1098 is missing information or if you need help deciphering it. To do this sign into TurboTax and click Deductions Credits Search for PMI search button on top right of screen and click the Jump to. Learn About Our Tax Preparation Services and Receive Your Maximum Refund Today.

Ad Every Tax Situation Every Form - No Matter How Complicated We Have You Covered. Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Heres how to enter your mortgage interest statement in TurboTax. 750000 if the loan was finalized after Dec. Start basic federal filing for free.

Mortgages can be considered money loans that are specific to property. Web Basic income information including amounts of your income.

Mortgage Interest Tax Relief Changes Explained Taxscouts

Free 46 Statement Forms In Ms Word Pdf

Free 46 Internship Application Forms In Pdf Ms Word

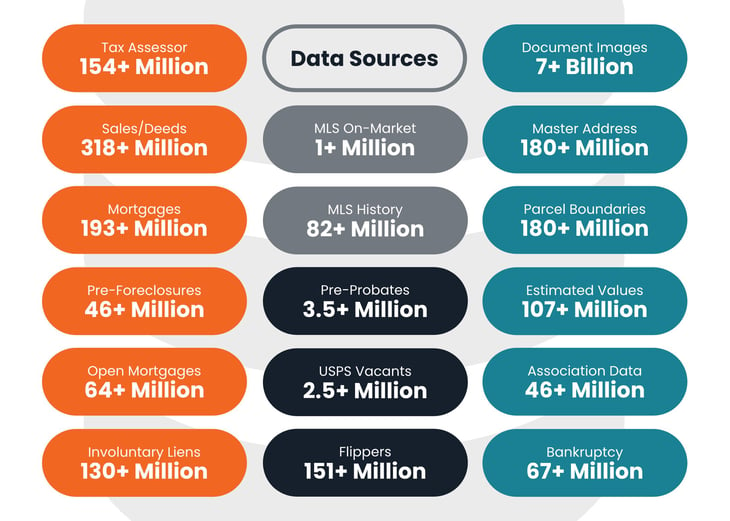

Propstream The Leaders In Real Estate Investment Data

Mortgage Interest Deduction A Guide Rocket Mortgage

Is It The Government S Responsibility To Reduce Income Inequality An Age Period Cohort Analysis Of Public Opinion Toward Redistributive Policy In The United States 1978 To 2016

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Ex 99 2

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Do I Claim The Mortgage Interest Deduction

Here S What To Know About Turo And Credit Scores

How Do I Claim The Mortgage Interest Deduction

Free 46 Internship Application Forms In Pdf Ms Word

Interest Income Ef Messages 5378 And 5285

Faq 2022 Bond Aransas Co Independent School District

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

Hosim Remote Controlled Car Adult With 2 Batteries 30 Min Playtime 1 10 Rc Offroad Truck 46 Km H Electronic 4wd Toy Car Children Red Amazon De Toys